pa local services tax deductible

Local Income Tax Requirements for Employers. In the past it could be deducted as a unreimbursed.

Thus it is not a deductible local income tax.

. The PA Local Services Tax is an employment related tax not based upon income amount. In the Deductions for Benefits section select Add a Deduction. Employees working in Pennsylvania are subject to the annual Local Services Tax LST.

I tracked down the difference to my local services. Ad Our free federal filing includes life changes and advanced tax situations. If your municipality charges a local services tax LST you may be wondering if the amount from your W-2 box 14 LST category can be deducted on your federal income taxes.

In tracking it down I found that. Wheres My Income Tax Refund. I live in PA.

DCED Local Government Services Act 32. LST is also known as the head. I have an LST or Local Services Tax in box 14.

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local. For areas under Act 199 deductions will be greater. Deductions Allowed For Pennsylvania Tax Purposes.

Pennsylvania Local Services Tax. Pennsylvania Department of Revenue. The total LST paid by an individual in a calendar year is generally limited to 5200 regardless of the number of taxing districts in which an individual works during the year.

It is due quarterly on a prorated basis. The Local Services Tax is imposed upon each individual engaged in any occupation in Middletown Township. DCED lacks the legal authority to extend the statutory local filing and payment.

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Turbo tax imported this as Other mandatory deductible state or local tax not listed. For Type select Other after tax deductions.

E-File Directly to the IRS. Restricted tax credits claimed on Line 23 of the PA-40 Personal Income Tax Return or Line 14 of the PA-41 Fiduciary Income Tax Return are listed on PA-40 Schedule OC. District PSD Code District Name Tax Collection Agency Website Tax Officer.

Free Federal and low cost State Tax Filing. Property TaxRent Rebate Status. It is the responsibility of the employer to deduct from.

Formerly the Emergency and Municipal Services Tax Pennsylvania Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the. This tax is withheld based on employment location for both Pennsylvania residents and nonresidents. In tracking it down I found that my deductions for state and local taxes are off.

Local Income Tax Information. On the drop-down select New Deduction thn Other deductions. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

In the Deductions for Benefits section select Add a Deduction. I found my refunds to be off by 11 Turbo tax being higher. To connect with the Governors Center for Local Government Services GCLGS by phone call 8882236837.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Are Moving Expenses Tax Deductible Guide For 2022 Updated

Pennsylvania Employment Tax Tutorial

What Are Itemized Deductions And Who Claims Them Tax Policy Center

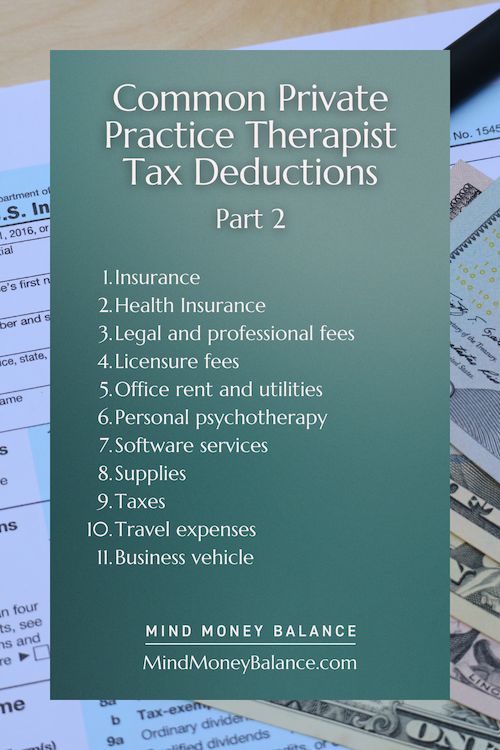

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Moving Expenses Tax Deductible Guide For 2022 Updated

Cell Phone Tax Wireless Taxes Fees Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Moving Expenses Tax Deductible Guide For 2022 Updated

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Top End Of Year Tax Write Offs For Landlords And Real Estate Investors